How can I make Year End go smoothly this time?

I’m sure this is a question many people ask themselves. Here you are again ready to close down another year. The routine we all have do just once a year which often fills us full of dread. There is a feeling that it wasn’t difficult last year, the problem is we just can’t remember what the steps were and which order we need to do them. Read on for more info and register for our webinar here: https://bit.ly/2BsaYZF

Some accounting software have period close routines that would fill any user with trepidation, but thankfully that is not the case with NAV. In this post I’ll give you some top tips on ways to ensure you can make your year end process go smoothly. We’ve been using NAV for many years, so know exactly how simple the process can be.

Did you know that NAV lets you close the year, yet still post into a closed year if you have the right permissions? Sure you’ll have to say yes to lots of warnings asking if you really want to – but it will let you do it. This is just one of the many great practical features of NAV. In real-life we sometimes do have adjustments to make to the final accounts, even a few months after the official end of year.

The “Close Year” function

The one thing you can’t do after a year is closed is change the account date periods. Have a look under calendar setup on the Navigate tab, and check you are happy with the period start and end dates, not just for the year but also each month. All the dates are shown on the accounting period page and this is where you can create new periods, e.g. years/quarters, etc. There is an automatic routine “Create Fiscal Year” that will set up a new year for you, but you’ll have to do the work to create your quarters manually.

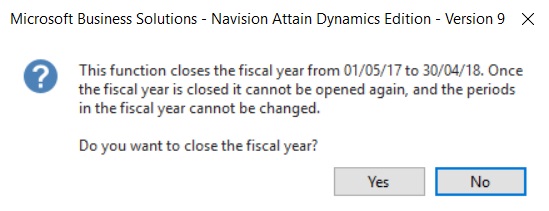

If you are happy with the dates for the year you are going to close and the dates for any periods within the year are correct then go ahead and run the “Close Year” function. You’ll get the warning below which you need to say yes to before moving to the next stage.

Once the year is closed you can now go ahead and run the “Close Income Statement” routine. But before you do, take a quick scan down your Chart of Accounts and make sure all of those in the balance sheet number range have the field “Income/Balance” set to Balance. You’ll need to check the same field for your Profit or Loss accounts – but they need to have Income set in the Income/Balance field.

The “Close Income Statement” routine

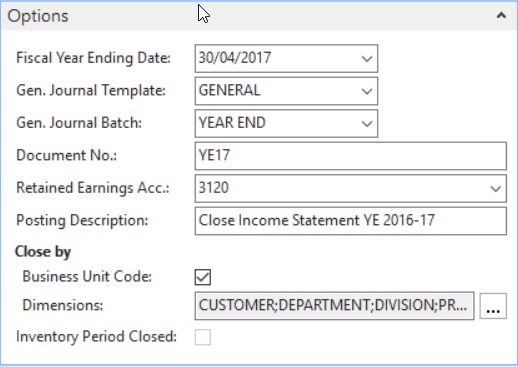

Running the “Close Income Statement” creates an unposted journal. The journal takes any balances on accounts set as Income down to zero and posts the transaction to your retained earnings account. The routine needs you to choose where you want the journal to be created (it will just sit there as an unposted document until you go and post it) and what account you want to use as retained earnings. If you have your accounts set to require dimensions then you need to select the dimensions in the Close By section of the routine. If you get it wrong and the journal won’t post, don’t worry just delete the unposted journal and run the routine again with the correct dimensions selected. You’ll just get a new journal created for you to post.

The nice thing about the “Close Income Statement” routine is if you do have to make some changes to the numbers in the accounts for the year, then post these journals and go ahead and run the routine again. It will just take the balances on those accounts affected and move them to retained earnings.

Here’s a screen shot of what the “Close Income Statement” page looks like. We have found it best to run our routine in the evening when there are less users on the system so as to not slow anyone down.

The “C date”

The last thing to tell you about the closing journal is that it has a special date. For the example shown above the entries will be posted at a point in time between 30/04/17 and 01/05/17. This is known as C30/04/17. If you run a report for 30/04/17 the balances will be shown on the income accounts; but if you run the same report with the date C30/04/17 the income accounts will be zero with the balance sitting in the retained earnings account you specified. Isn’t that useful? That way you can view the accounts in a way that suits your own business reporting needs.

So now you know all you need to finish the year. If you have any questions or comments I’d love to hear them. This is the best way we’ve found to navigate the Year End process. We are also running a TVision webinar about this later this month, if you’d like to register, sign up here: https://bit.ly/2BsaYZF

By Nicola Bourne – Support Manager