At the beginning of September, HMRC held a webinar on how businesses can best prepare for Brexit, and how they could be affected when importing and exporting to the EU.

Discussing the need for an Economic Operator and Registration Identification (EORI) number, the webinar provided a basic overview for moving goods into and out of the UK, in order to make it easier for organisations to continue trading.

It’s increasingly important for businesses to understand the impact Brexit and new procedures will have on them, and likewise the impact this will also have on their suppliers.

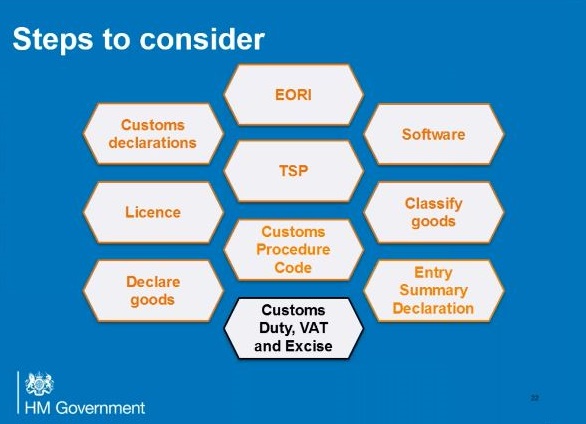

Key areas covered included:

- Applying for an EORI number

- Preparing to make customs declarations

- Transitional Simplified Procedures (TSP)

- Entry Summary Declarations

- Paying customs, duty, VAT and Excise.

Why is this important?

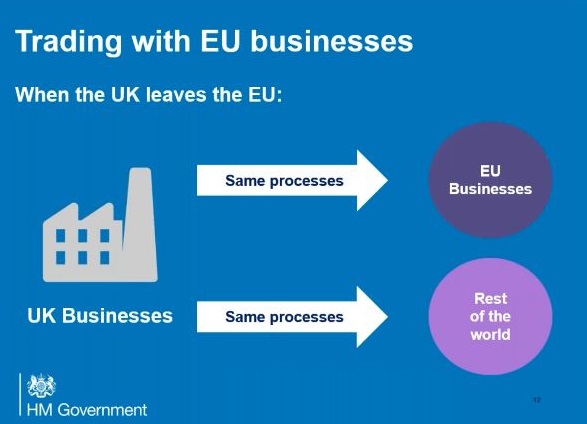

When the UK leaves the EU, the UK will need to apply the same processes to trading with EU businesses as it does to trading with the rest of the world.

To do this HMRC provided a checklist to help prepare for Brexit. How many of these to you already have in place?

- Get an EORI number starting with ‘GB’

- Decide how you want to submit customs declarations

- Get software or an agent to make software declarations

- Check to see if you can use TSP for importing

- Check to see if you need a licence to import/export goods

- Classify your goods

- Apply the right customs procedure code

- If you use a UK roll-on/roll-off location, declare your goods before they board their transport vessel

- Find out if you need to submit an Entry Summary Declaration – also known as a, Safety & Security Declaration

- Pay customs duty and any VAT and excise duty that is due.

Ireland and Northern Ireland

Covering the affect importing and exporting will have on Irish and Northern Irish businesses, the webinar stated that the UK government is committed to having no hard border between Ireland and Northern Ireland.

Taking a temporary, unilateral approach to checks, processes and traffic, the advice is to follow import and export guidance from the Irish government.

Currently there are no new requirements or checks on goods moving between Ireland and Northern Ireland.

There is also no current need to make customs import declarations to HMRC unless goods are controlled/licenced or liable to Excise Duty.

The UK temporary tariff regime does not apply to goods moving from Ireland to Northern Ireland.

However, it does apply if:

- Goods are imported to Northern Ireland from another EU country

- Goods are moved from Northern Ireland to Ireland, and all other EU countries.

Registering for an EORI number

To find out more about an EORI number, please read our blog ‘Have you got your Economic Operator Registration and Identification number?’ [Add link to blog]

If you have an EORI number that starts with ‘EU’ you will need to register for one beginning with GB to declare your goods for import/export. But you can continue to use your ‘EU’ EORI, for EU declarations.

Preparing to make customs declarations

UK businesses will need to make customs declarations when:

- Importing or exporting goods

- Moving goods between the EU and UK

- Paying any import duties/excise duties

- Paying import VAT that may be due.

This means UK traders not currently making declarations will need to after Brexit eventually takes place. This can be done yourself, or via a third party.

The earlier you make this decision, the more time you will have to make any changes.

You can find more help and tips with this on the webinar – watch here.

Transitional Simplified Procedures (TSP)

If you buy goods from the EU, HMRC has introduced TSP to make importing from the EU easier.

TSP can only be used though, when importing goods from the EU. Introduced for a limited period, registering is easy and free. But why register for TSP?

Under important rules for trading with the rest of the world, goods are not released from custom control until you’ve made a full declaration and paid customs duty.

TSP therefore reduces the information needed, letting you delay:

- Submitting a full declaration

- Paying duty.

You CAN register for TSP if you:

- Have an EORI number starting with GB

- Are established in the UK

- Are importing goods from the EU to the UK.

You should NOT register for TSP if:

- The only goods imported are coming into the UK directly from outside the EU

- You use a customs special procedure

- You are acting on behalf of a trader

- You have overdue tax returns, tax payments, or your business is insolvent.

TSP applies to roll-on and roll-off locations, i.e. Dover and the Channel Tunnel, ports and airports.

TSP will be in place for a year, and you can register online – find out more here.

For full TSP examples, please watch the webinar, as HMRC go into greater detail.

For Entry summary declarations and paying customs duty, VAT and excise, please also see the webinar for more information, as there are high level overviews discussed in detail that are important to see.

Watch the webinar here.

Useful links

To help find the relevant information for you, you may find some of the following links useful:

Get your business ready to export from the UK to the EU after Brexit

Get your business ready to import from the EU to the UK after Brexit

Transitional simplified procedures (TSP)

Getting help from third parties

Deciding which customs procedures to use

Prepare your business or organisation for Brexit

Prepare your business for Brexit

Watch the webinar

As mentioned throughout this blog, the webinar covered a lot of information, therefore we recommend watching the recording in full (approximately an hour) for a more in depth look at all the topics covered. You can watch it here.

If you have any questions about this or how TVision are managing Brexit, and you’d like to discuss this with us, please get in touch with one of our experience team.