As many of you will already know, bank reconciliation is the process of whereby a business checks, compares and matches the statements received from their bank with the bank records set up in their finance and accounting system. It is an important and practical way for a business to discover and resolve missing payments and bookkeeping errors. In this blog, we take a look at the bank reconciliation process in Business Central and offer some best practice tips.

Creating a new bank reconciliation in Business Central

The first step is to create a new bank account reconciliation:

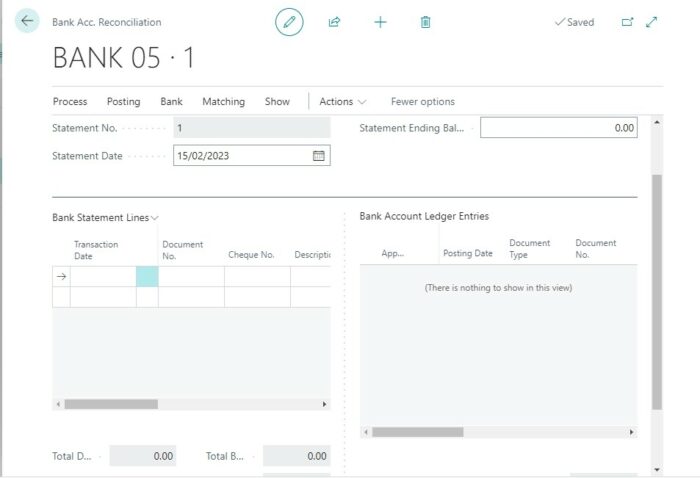

- Select New to open a new Bank Acc. Reconciliation window

- Fill in the general details such as Bank Account No using the drop-down menus

- Statement numbers are incremental based on previous statements and the statement date needs to align with the date provided on your bank statement

- The lines on the Bank Acc. Reconciliation page are divided into two panes: the Bank Statement Lines and the Bank Account Ledger Entries

- The Bank Statement Lines pane shows either imported bank transactions or ledger entries with outstanding payments

- The Bank Account Ledger Entries pane shows the ledger entries in the internal bank account.

Importing bank statement data into Business Central

Data from your bank statement can be imported into your Bank Acc. Reconciliation page in three different ways:

- Manual entry – With this approach, you manually type in the data for each individual line on your bank statement. Although this is the simplest option, it is time consuming and prone to human error.

- Import Bank Statement – With this option, you download your bank statement in a suitable format (such as a csv file) and then import this file directly into BC. To do this, click on Bank>Import Bank Statement>Choose File>Import.

- Suggest lines – One of the many automation features that BC includes is the ability to auto-generate your bank statement lines based on the ledger entries. This can be helpful but it is important to be aware that it can cause duplications or missed data.

Matching the data

Once you have your bank statement lines imported into your Bank Acc. Reconciliation page, the next step is to match this data with the Bank Account Ledger entries (this is the information already in BC from the General Journal).

There are two ways to do this data matching exercise:

- Manual matching – There are times when you can clearly see that there is a match on the Bank Statement and Bank Account Ledger entries. When this happens, you can simply select the two lines and click on “match manually”.

- Automatic Matching – Manual matching isn’t always suitable, especially when you are dealing with large amounts of data. For times like this, BC has “automatic matching” functionality.

- Once the Match Automatically function is selected, the Match Bank Entries page opens.

- The user then selects a Transaction Data Tolerance (how many days before and after the bank account ledger entry posting date BC will search for matching transaction dates in the bank statement lines). It is important to note that if you enter 0 or leave the field blank, BC will only search for matching transaction dates on the bank account ledger entry posting date.Once you select OK, all the bank statement lines and bank account ledger entries that can be matched change to green and the Applied checkbox is selected.

- If a line is automatically matched incorrectly, you can select the bank statement line and then choose the Remove Match action.

Generally, users utilise a mix of manual and automatic matching when doing bank reconciliations. It is important to note that if you have manually matched entries, automatic matching will not overwrite your selection.

Reconciling unmatched entries

Once the data matching exercise is completed, you will probably have some unmatched lines which will need to be resolved before you can complete the bank account reconciliation. To view these unmatched lines, click on Show>Show Unmatched.

The following table describes a few typical business situations that can cause unmatched lines:

| Difference | Reason | Resolution |

| A transaction in your bank account in Business Central isn’t in the bank statement. | The bank transaction wasn’t created although a posting was made in Business Central. | Create the missing transaction (or prompt a debtor to make it). Then reimport the bank statement file or enter the transaction manually. |

| A transaction on the bank statement doesn’t exist as a document or journal line in Business Central. | A bank transaction was made without a corresponding posting in Business Central, for example a journal line posting for an expense. | Create and post the missing entry. To learn a quick way to do that, see To create missing ledger entries to match bank transactions with. |

| A transaction in the internal bank account corresponds to a bank transaction but some information is too different to give a match. | Information, such as the amount or the customer name, was entered differently in the bank transaction or the internal posting. | Review the information, and then manually match the two. Optionally, correct the mismatch. |

Posting the bank reconciliation

Once your unmatching lines are resolved, either by creating the missing entries or correcting non-matching information, you are ready to post your bank reconciliation.

Before you do this, you need to complete two final checks:

- Ensure that your total difference value on the Bank Acc Reconciliation page is zero.

- Make sure that the total balances on both panes of the page match.

Once this is done, you can post your bank reconciliation.

Benefits of using Business Central for bank reconciliations

Performing bank reconciliations in Business Central is a simple and accessible process. Using the Bank Acc Reconciliation page and using the range of tools BC offers will allow you to effectively and efficiently resolve any missing payments and bookkeeping errors. And, in turn, give you peace of mind.

Want to find out more?

If you have any questions about Business Central and how moving to it can streamline your day-to-day financial processes, such as bank reconciliations, contact us and we’ll be happy to discuss it with you.